AIA PAM Conservative Fund. PRS or Private Retirement Scheme is another place to park and grow your retirement savings.

Learn More About Prs Private Pension Administrator Malaysia Ppa

For public employees there is the Kumpulan Wang Persaraan Diperbadankan or KWAP Malaysia which focuses on managing retirement and pension funds for civil servants.

. Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement. The 10 best overseas retirement and lifestyle havens for 2022. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

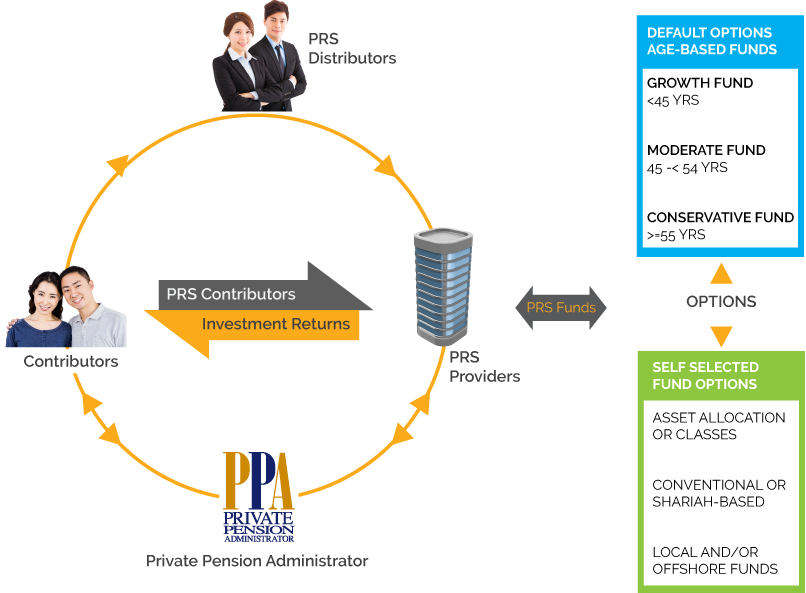

Four Factors to Get a Better Handle on How Much Money You Could Need to Retire. Ad AARPs Retirement Resources Could Help You Determine How Much Money You Need to Retire. The Mechanism of Private Retirement Scheme Malaysia As the name implies PRS is privately managed by asset management companies also known as PRS providers.

30 rows AIA Pension and Asset Management Sdn Bhd. The Private Pension Administrator Malaysia PPA is the central administrator of the private retirement scheme and they are responsible for managing your account and facilitating. PRS is a voluntary long-term investment and saving scheme designed to help you save adequately for retirement.

AIA PAM Growth Fund. Find out what are the best Malaysian Private Retirement Schemes PRS to invest in in 20202021. Private Pension Administrator Malaysia PPA is the Central Administrator for the Private Retirement Schemes PRS.

AIA PAM Moderate Fund. Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. Save invest and retire wellPrivate Retirement Schemes Quick Overview.

Ad The 10 best places to retire overseas in 2022. Best private retirement scheme malaysia The National Pension Scheme SBI account holders will each receive a Permanent Retirement Account Number PRAN that will remain fixed throughout. If yes you may want to consider investing in a Private Retirement Scheme PRS.

The PRS was launched in July 2012 with the objective of offering Malaysian employees and the self. In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan. Thats the money you need when you hit 5560 years old depending on.

PRS seek to enhance choices available for. AIA Private Retirement Scheme. The Private Retirement Schemes PRS are offered by eight 8 PRS Providers who are fund management companies approved by the Securities Commission MalaysiaSC.

PRS offers the safest most flexible and regulated retirement.

6 Actionable Tips For Growing A Successful Business Investing For Retirement Best Savings Account Tax Saving Investment

Structure Of Prs Private Pension Administrator Malaysia Ppa

Prs Funds Information Private Pension Administrator Malaysia Ppa

I Save In Prs Private Pension Administrator Malaysia Ppa

Prs Fees Comparison Private Pension Administrator Malaysia Ppa

Cover Story Is Prs Outperforming Epf The Edge Markets

Private Retirement Scheme Principal Asset Management

Which Prs Funds To Invest In 2020 2021 Mypf My Investing Financial Literacy Fund

Structure Of Prs Private Pension Administrator Malaysia Ppa

Private Retirement Scheme Principal Asset Management

Structure Of Prs Private Pension Administrator Malaysia Ppa

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Prs For Self Employed Private Pension Administrator Malaysia Ppa

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Which Prs Funds To Invest In 2020 2021 Mypf My

Structure Of Prs Private Pension Administrator Malaysia Ppa

Beginner S Guide To Private Retirement Schemes Prs In Malaysia